Market Analysis Review

U.S. GDP growth slows(Q1), U.S. unemployment claims retreat slightly, Advanced GDP price index (Q1) rose to 3.1%, U.S. dollar weakened, JPY weakened, Commodities to the upside

Previous Trading Day’s Events (25.04.2024)

U.S. Gross Domestic Product (GDP) increased at a 1.6% annualised rate last quarter versus a forecast of GDP rising at a 2.4% rate.

Peter Cardillo, Chief Market Economist, Spartan Capital Securities, New York

“The economy continues to grow, but at a slower pace and you still have a sticky inflation, that just means that the Fed is not likely to cut in June and a big question mark for the remainder of the year.”

“This is good news and bad news in the GDP because slower growth would ordinarily mean lowering of the dollar and yields, (but) with the PCE price deflator coming in on the higher side that is pushing up yields.”

______________________________________________________________________

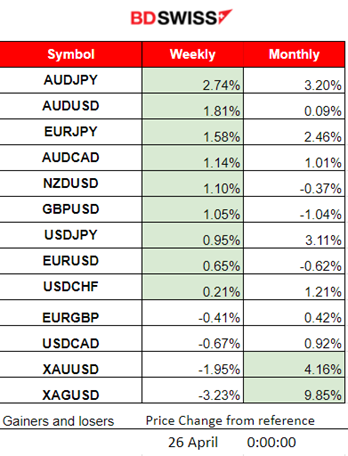

Winners vs Losers

AUDJPY remains on the top of the weekly list of gainers with 2.74% gains. The JPY is weakening significantly. AUD seems to lose ground as well rapidly. Silver gained again, reaching a 9.85% performance for the month.

______________________________________________________________________

______________________________________________________________________

News Reports Monitor – Previous Trading Day (25.04.2024)

Server Time / Timezone EEST (UTC+03:00)

- Midnight – Night Session (Asian)

No important announcements, no special scheduled releases.

- Morning – Day Session (European and N. American Session)

At 15:30 the Advanced GDP figure (1st quarter 2024) for the U.S. was reported lower at 1.6% versus the expected 2.5%. The market reacted with sudden USD depreciation at first but it reversed soon to a strong appreciation and later another reversal confirmed the strong uncertainty that is governing the market currently. Why? Inflation is hotter with the core PCE deflator up 3.7% annualised versus 3.4% expected. Unsurprisingly, Treasury yields have pushed higher. Near-term Federal Reserve interest rate cuts are less likely to take place.

General Verdict:

__________________________________________________________________

__________________________________________________________________

FOREX MARKETS MONITOR

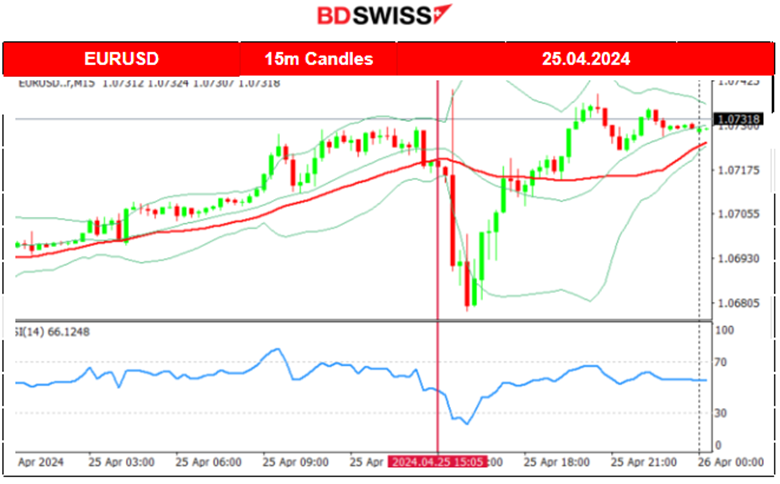

EURUSD (25.04.2024) 15m Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

The pair moved to the upside early as the USD was depreciating against other currencies steadily. After the U.S. GDP news the USD weakened momentarily, a first reaction from the market participants, causing the EURUSD to experience an intraday shock and jump but only to drop sharply immediately near 60 pips. After finding support at near 1.06770, the USD started to depreciate steadily. The pair soon reversed to the upside, crossing the 30-period MA on its way up, and overall closed higher for the trading day.

___________________________________________________________________

___________________________________________________________________

CRYPTO MARKETS MONITOR

BTCUSD (Bitcoin) Chart Summary 1H

Server Time / Timezone EEST (UTC+03:00)

Price Movement

Bitcoin halving took effect late on Friday 19th of April, cutting the issuance of new bitcoin in half. It happens roughly every four years, and in addition to helping to stave off inflation, it historically precedes a major run-up in the price of Bitcoin.

Its price started slowly to move to the upside and experienced an uptrend during the weekend. Since the 20th of April, the price moved to the upside post-halving. Bitcoin was on an uptrend with the price moving within a channel. Since the 23rd upside slowdown took place as volatility levels lowered forming a triangle, trading around the 67K USD level. On the 24th of April, a breakout of that triangle occurred to the downside, with the price reaching the support near 63,500 USD before retracement took place. The new bill from Congress might be the cause:

Additionally, a breakout to the downside occurred yesterday with the price reaching 62,700 USD before reversing again close to the MA.

Crypto sorted by Highest Market Cap:

Crypto sorted by Highest Market Cap:

Crypto prices remained stable. There is no significant improvement. Most of the data for performance are mixed.

Source: https://www.investing.com/crypto/currencies

_____________________________________________________________________

EQUITY MARKETS MONITOR

S&P500 (SPX500) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

The breakout to the upside and of the 5,000 USD level led to a jump of 30 USD on the 22nd of April and a retracement took place soon after. This eventually was the start of an uptrend as mentioned in the previous analysis. The resistance of 5,040 USD tested again and the breakout that followed caused the price to reach 5,095 USD before retracement took place on the 24th of April. On the 25th of April, the market experienced a sudden plunge causing the index to drop to the support near 4,990 USD before eventually reversing heavily to the upside. It crossed the 30-period MA on its way up and reached remarkably back to the 5,100 USD level.

______________________________________________________________________

______________________________________________________________________

COMMODITIES MARKETS MONITOR

USOIL (WTI) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

On the 25th of April, the resistance of 83.5 USD was broken and the price reached higher, reaching near 84 USD/b. Crude oil’s volatility could help the price to reach even the 85/b level which acts as a resistance level during this period.

XAUUSD (Gold) 4-Day Chart Summary

XAUUSD (Gold) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

On the 19th of April the news regarding the Israel attack in Iran, caused the commodity prices (Gold and Oil) to jump but only to reverse soon after fully. Gold retreated eventually lower reaching the support at 2,350 USD/oz. On the 22nd the downside path continued aggressively and today it even reached support at 2,300 USD/oz. That eventually acted as a turning point to the upside and a retracement to 2,330 USD/oz, close to the MA. On the 24th of April, the price remained stable. Could be the case that 2,340 could be tested again. Seems an important resistance level. However, On the H4 though it is more clear that we are currently on the upper band and the prospect for a downside movement is high. The proposed range is 2,300-2,340 USD/oz. It would be unlikely to see a jump to 2,400 USD/oz. For that to take place we should see an unusual increase in demand for metals.

______________________________________________________________

______________________________________________________________

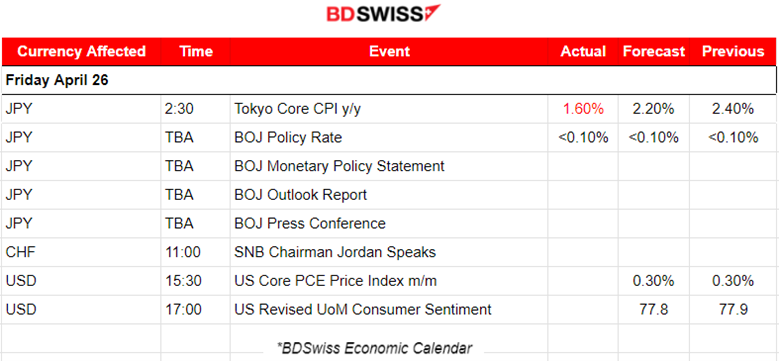

News Reports Monitor – Today Trading Day (26 April 2024)

Server Time / Timezone EEST (UTC+03:00)

- Midnight – Night Session (Asian)

Tokyo inflation slowed for the 2nd straight month according to the report released at 2:30. The actual figure was reported as 1.6% versus the expected 2.2%. The market did not react to the news as they were waiting for the BOJ news first. Core inflation fell below the central bank’s 2% target, complicating its decision on how soon to raise interest rates.

Bank of Japan interest rate decision: Unchanged at 0%-0.10%. This follows the first rate hike since 2007, which was implemented in March. While the move was expected, this comes after Tokyo’s April inflation came in lower than expected. JPY depreciated heavily and the USDJPY jumped. JPY is expected to weaken further unless there is BOJ intervention soon.

- Morning – Day Session (European and N. American Session)

At 15:30 the U.S. Core PCE Price index figure will be released. The change is expected to remain steady at 0.3%. Previous inflation-related readings have shown that inflation is actually showing an uptrend instead of slowing down. USD pairs will be affected probably if there is a surprise to the downside. That could cause the dollar to weaken in the short-term or intraday at least.

General Verdict:

______________________________________________________________